A Plan That Works!

Did you know that 80% to 90% of the time, standard retirement plans will fail?

This is why:

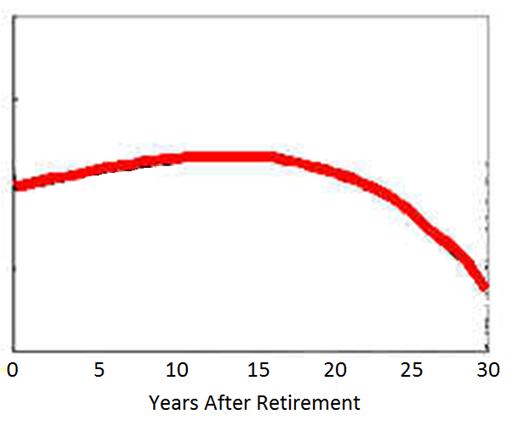

Take for example a retiree who has one million dollars in his investment portfolio at the beginning of his retirement. He takes out $60,000 annually, indexed to inflation. Assume his portfolio grows 8% and inflation is 3.5% per year.

In the chart below, the red line shows the outcome from a standard retirement calculator. It shows the change in portfolio value over a 30 years time horizon. At first glance, it appears wonderful; the portfolio seems to last longer than 30 years.

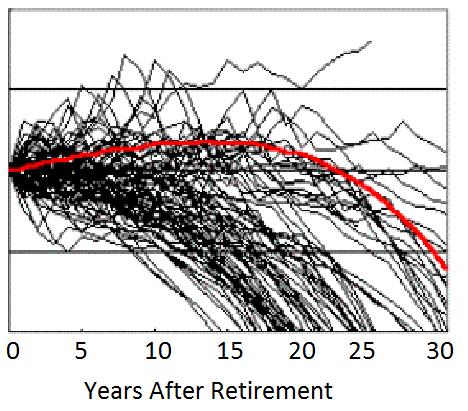

Now, calculate the portfolio value if this person were to start his retirement in any year during the last century using actual market data and inflation. Let us assume a conservative asset mix (60% fixed income and 40% equity). Each black line shows the actual portfolio value for retiring in a particular year since 1900.

Most portfolios expired well before the red line. The red line is the projection of the standard retirement calculator.

Why Guess? Why Gamble?

Why Not Use The Actual, Unadulterated Historic Market Data?

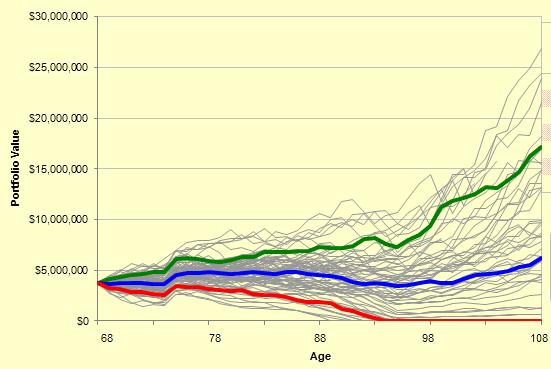

The Advanced Retirement Planning method makes no predictions. Instead it analyses a specific individual's exact circumstances and calculates how his plan would have succeeded had it begun in each of the past 100 years. While the outcomes vary considerably, it does provide a true and historic landscape that helps to make intelligent decisions today and determine the required preparedness to face adversity tomorrow.

Probabilities of Success And Facing Adversity

It is important that a retirement plan be prepared to handle adversity. After all, no one wants to go back to work at 83 and for many this would not be possible. Using the historic record, the individual plan below at the red has a 90% probability of success. Therefore a successful plan must have a red line (90% probability line) that reaches, to a minimum, the lifespan of the retiree.

While having a plan with a 90% probability of success offers considerable comfort, there can be events and unexpected circumstances that may affect the long-term viability of the plan. What kind of hits can the plan experience and still be successful?

Our method allows us to "stress test" each plan to determine limits to capital loss, withdrawal increases, higher than average inflation, and a longer than expected life span and more. With this capability we not only advise clients on their plan but help them manage their retirement resources for optimum performance over time.